Apple Scales Back Vision Pro: A Deep Dive into Production Cuts and the Reality of Sluggish Sales 🚨

In the fast-paced world of tech innovation, few companies command as much attention as Apple. Yet, even giants stumble. Recent reports have sent shockwaves through the industry: Apple has reportedly slashed production of its ambitious Vision Pro headset due to disappointingly low sales. Launched with fanfare as the dawn of “spatial computing,” the device promised to blend digital worlds seamlessly into our physical reality. But nearly three years on, the Vision Pro’s journey has hit turbulence. This blog post unpacks the full story – from the hype of its debut to the harsh market realities forcing Apple’s hand. We’ll explore the numbers, the reasons, the responses, and what this means for the future of augmented and virtual reality (AR/VR). Buckle up; it’s a tale of high stakes, higher prices, and the unforgiving consumer landscape. 📱✨

The Vision Pro Origin Story: From Hype to Hardware 📜

To understand the current setback, let’s rewind to June 2023, when Apple CEO Tim Cook unveiled the Vision Pro at the Worldwide Developers Conference (WWDC). Billed as Apple’s first foray into spatial computing, the headset was no mere VR gimmick. It featured ultra-high-resolution displays (more pixels than a 4K TV per eye), advanced eye-tracking for intuitive controls, and seamless integration with Apple’s ecosystem. Users could “pin” apps in their real-world environment, watch immersive videos, or collaborate in virtual spaces – all without traditional controllers. Cook called it “the most advanced consumer electronics device ever created,” blending digital content into the space around us. 🔥

The launch was met with a mix of awe and skepticism. Priced at a staggering $3,499 for the base model (rising to over $4,000 with accessories like Zeiss optical inserts), it targeted early adopters and professionals rather than the mass market. Initial reviews praised its technological prowess: The Verge hailed it as “magic until it’s not,” while CNET noted its potential to redefine productivity. But whispers of challenges emerged early – weight issues (around 650 grams, akin to wearing a small tablet on your face), short battery life (about two hours), and a nascent app ecosystem. Despite this, Apple shipped around 500,000 units in its first year, a respectable figure for a premium niche product.

Fast-forward to 2025, and the narrative shifted. An upgraded M5 version arrived in October, boasting a faster chip, improved battery (up to three hours), and a redesigned headband for better comfort. Yet, even this refresh failed to ignite demand. As we enter 2026, the Vision Pro’s sales have plummeted, prompting drastic measures.

Sales Slump: The Numbers Don’t Lie 📉

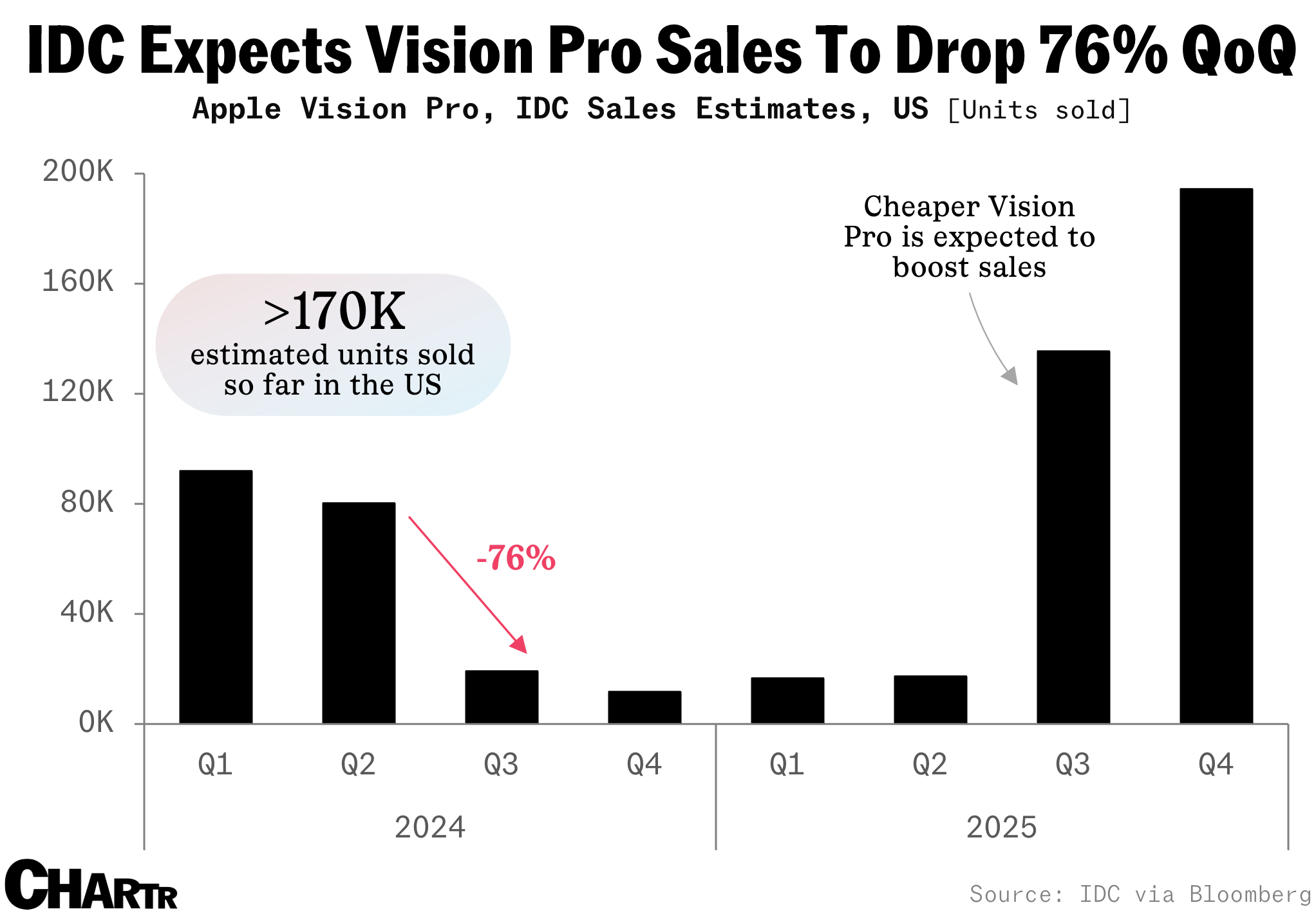

Apple has remained tight-lipped on official sales figures – a telltale sign when things aren’t rosy. However, independent analysts paint a grim picture. The International Data Corporation (IDC) estimates that Apple sold just 45,000 Vision Pro units in the crucial fourth quarter of 2025, the holiday shopping season. That’s a far cry from the millions of iPhones, iPads, and MacBooks Apple moves quarterly. For context, if each unit sold at the base price, that’s roughly $157 million in revenue – not chump change, but peanuts compared to Apple’s overall $383 billion annual haul.

Counterpoint Research forecasts a 14% year-on-year decline in the global VR headset market for 2025, underscoring that Vision Pro’s woes aren’t isolated. Total shipments for Apple’s device hovered around 390,000 in 2024 (its launch year), dropping sharply thereafter. By October 2025, cumulative sales reached about 1 million units, but momentum stalled. In comparison, Meta’s Quest lineup – starting at a wallet-friendly $370 – commands 80% of the market share. Meta shipped millions of units annually, even as it too reduced marketing spend amid softening demand.

Why the Vision Pro Fell Short: Breaking Down the Barriers 🛑

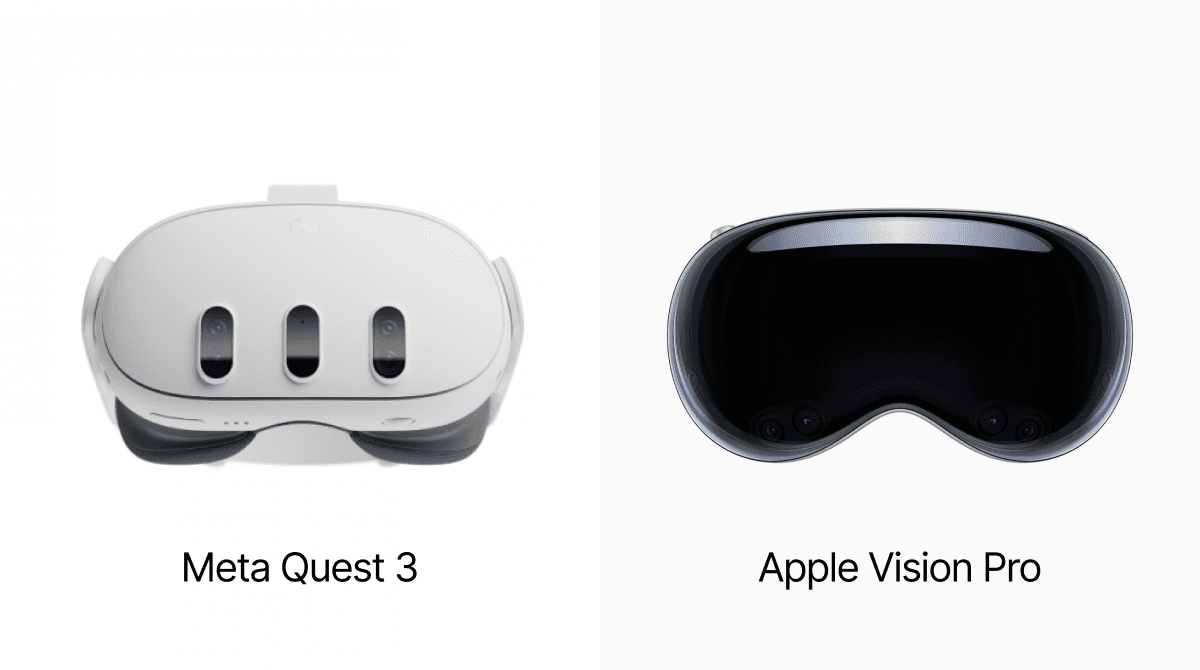

The Vision Pro’s underperformance stems from a perfect storm of factors. First and foremost: the price tag. At $3,499, it’s more than a high-end MacBook or multiple iPads combined. In an economy where inflation bites and disposable income shrinks, few consumers see it as essential. As one analyst quipped, “It’s a luxury for the ultra-wealthy, not a tool for the masses.” Morgan Stanley’s Erik Woodring pinpointed this, attributing sluggish sales to “cost, form factor, and the lack of VisionOS native apps.”

Comfort issues loom large too. Reviewers and users alike decry its weight, which causes neck strain after prolonged use. The external battery pack, while necessary for portability, adds bulk. Safety concerns surfaced early – videos of users driving while wearing the headset sparked backlash, echoing the social stigma of Google Glass wearers dubbed “glassholes” back in 2013. The isolating experience also deters casual adoption; it’s not something you slip on for a quick scroll like AirPods.

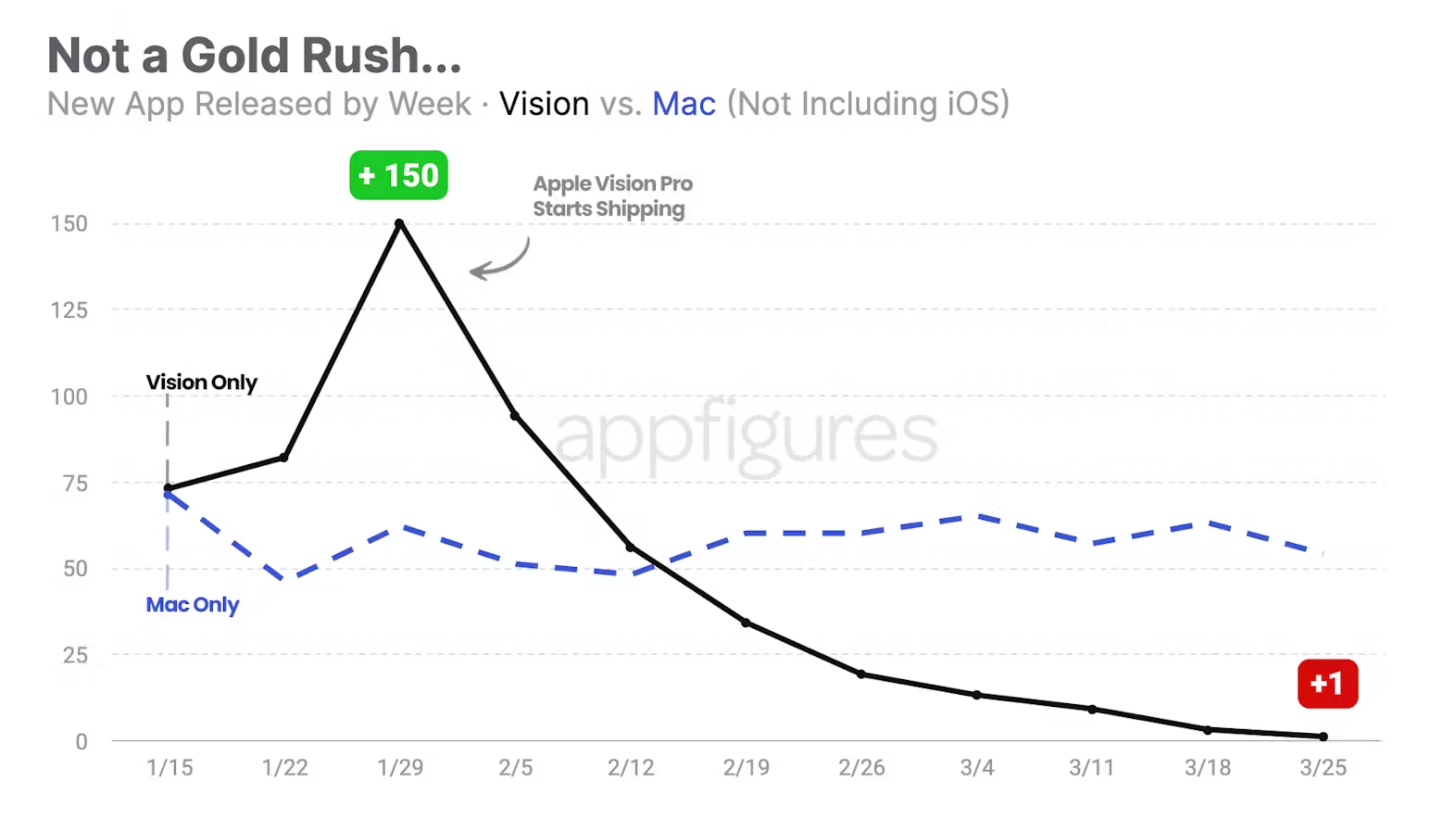

Then there’s the content drought. Apple boasts 3,000 apps tailored for VisionOS, but many are enterprise-focused – think surgery simulations or pilot training – rather than consumer hits. Appfigures notes this niche skew, contrasting with the iPhone’s explosive app growth post-2007. Without killer apps (beyond immersive video and spatial photos), the headset feels like a solution in search of a problem. Developers hesitate to invest due to the small user base, creating a chicken-and-egg dilemma.

Competition exacerbates these woes. Meta’s Quest 3S, priced under $300 with bundles, offers accessible VR gaming and social features. While less polished than Vision Pro, it’s “good enough” for most. The broader VR market’s 10% decline in 2024 (to 6.9 million units) reflects waning interest post-pandemic hype. Apple’s device, despite its innovations, couldn’t buck the trend.

Production and Marketing Pullback: The Hard Decisions 🔧

Faced with these headwinds, Apple acted decisively. Chinese partner Luxshare, the primary manufacturer, halted production entirely at the start of 2025 after fulfilling initial orders. This followed severe cuts in 2024, with manufacturing shifting partly to Vietnam for the M5 model. IDC reports confirm this ramp-down, noting Apple met inventory goals but saw no need for more amid excess stock.

Marketing followed suit. The 95% ad spend reduction isn’t hyperbole – it’s a strategic pivot away from a struggling product. Apple, known for lavish campaigns, went quiet on Vision Pro promotions, redirecting resources elsewhere. This mirrors Meta’s own cuts, as Zuckerberg’s company shifts from metaverse ambitions to AI glasses and wearables.

But is this a death knell? Not necessarily. Analysts argue the Vision Pro was never meant for mass appeal; it was a “tomorrow’s technology today” play. Even at low volumes, it’s profitable – each unit’s high margin ensures that. Plus, with around 1 million active users, it has seeded the spatial computing ecosystem, influencing OS updates across Apple’s lineup (e.g., Liquid Glass features in iOS 26).

Apple’s Pivot: Cheaper Models, AI Focus, and Lessons Learned 🔄

Apple isn’t abandoning AR/VR entirely. A lower-spec, cheaper Vision Pro variant is slated for 2026, potentially halving the price to broaden appeal. This could address cost barriers while retaining core features. Meanwhile, the company is doubling down on AI-enabled wearables, pausing next-gen VR to prioritize smart glasses. Rumors swirl of Apple Glasses competing with Meta’s Ray-Ban collaborations – lighter, more socially acceptable, and AI-infused for everyday use.

This shift aligns with industry trends. As VR cools, AI heats up – think ChatGPT integrations and real-time assistance. Apple’s Vision Pro experience provides valuable data for these ventures, from eye-tracking tech to spatial interfaces. Internally, success metrics likely focus on platform establishment over raw sales; by that measure, it’s no flop.

Historically, Apple has weathered similar storms. The Newton PDA flopped in the 90s but informed the iPhone. The Apple Watch started slow but now dominates wearables. Vision Pro could be a stepping stone, not a sinkhole.

Broader Implications: What This Means for Tech and Consumers 🌍

For Apple, this episode underscores diversification risks. The iPhone still drives half its revenue, and without a “next big thing,” pressure mounts. Yet, services growth (Apple TV+, Music) cushions blows, and AI pushes (like Apple Intelligence) offer new avenues. Stock-wise, AAPL dipped modestly on the news but remains robust – investors see Vision Pro as a side bet, not core.

The VR industry faces a reckoning. If even Apple struggles, can anyone succeed? Meta’s metaverse dreams have cost billions with mixed results. Consumer interest wanes without compelling use cases – gaming dominates, but productivity and social VR lag. Expect consolidation: Fewer players, more focus on enterprise (where Vision Pro shines in training simulations).

For consumers, it’s a reminder that tech hype doesn’t always translate to adoption. We crave innovation but balk at premiums without clear value. As prices drop and tech matures, AR/VR might yet go mainstream – perhaps via glasses, not bulky headsets.

Wrapping Up: A Bump in the Road or End of the Line? 🤔

Apple’s Vision Pro production cuts mark a rare admission of market miscalculation, driven by poor sales, high costs, and broader VR fatigue. From 500,000 first-year shipments to a paltry 45,000 in Q4 2025, the numbers sting. Yet, this isn’t Apple’s Waterloo. With a cheaper model on the horizon and a pivot to AI wearables, the company is adapting. Vision Pro laid groundwork for spatial computing, even if it didn’t soar commercially.

In tech, failure often breeds success. As Tim Cook might say, it’s about blending the digital and physical – and sometimes, that blend needs refining. Stay tuned; the future of computing is still unfolding. What do you think – is Vision Pro a flop or a foundation? Drop your thoughts below! 🚀