Samsung’s Bold Gamble: Losing Money on the Galaxy Z TriFold to Shape the Future of Foldables

🌟 Welcome to an in-depth exploration of one of the most intriguing stories in the tech world today. As we step into 2026, Samsung’s foray into tri-fold smartphones has captured headlines—not just for its innovative design, but for the surprising financial reality behind it. Reports indicate that the tech giant is incurring losses on every Galaxy Z TriFold sold, a move that seems counterintuitive at first glance. But is this a misstep or a calculated strategy? In this blog post, we’ll dive deep into the details, unpacking the device’s features, the reasons for these losses, sales figures, competitive landscape, and what it all means for the future of foldable technology. Buckle up as we unfold this story! 🚀

The Evolution of Samsung’s Foldable Journey

To understand the Galaxy Z TriFold’s place in Samsung’s lineup, we must first trace the evolution of foldable smartphones. Samsung pioneered the category with the original Galaxy Fold in 2019, a device that promised to redefine mobile computing by blending phone and tablet functionalities. Despite early hiccups like screen durability issues, it set the stage for iterative improvements. The Galaxy Z Fold2 in 2020 refined the hinge mechanism and introduced a larger cover display, while the Z Fold3 added S Pen support and water resistance. By the Z Fold4 and Z Fold5, Samsung focused on slimmer profiles and better multitasking software.

The Z Flip series, meanwhile, brought flip-phone nostalgia with a modern twist, emphasizing compactness and style. But the real game-changer came with tri-fold concepts. Rumors of a tri-fold device swirled for years, inspired by prototypes from competitors like Huawei. Samsung’s foldable sales have seen ups and downs; global shipments peaked around 10 million units annually but plateaued due to high prices and limited innovation. In 2024, the Z Fold6 faced criticism for minimal upgrades, leading to softer sales—only about 270,000 units in its first two weeks globally. This context is crucial: Samsung needed a bold move to reclaim leadership.

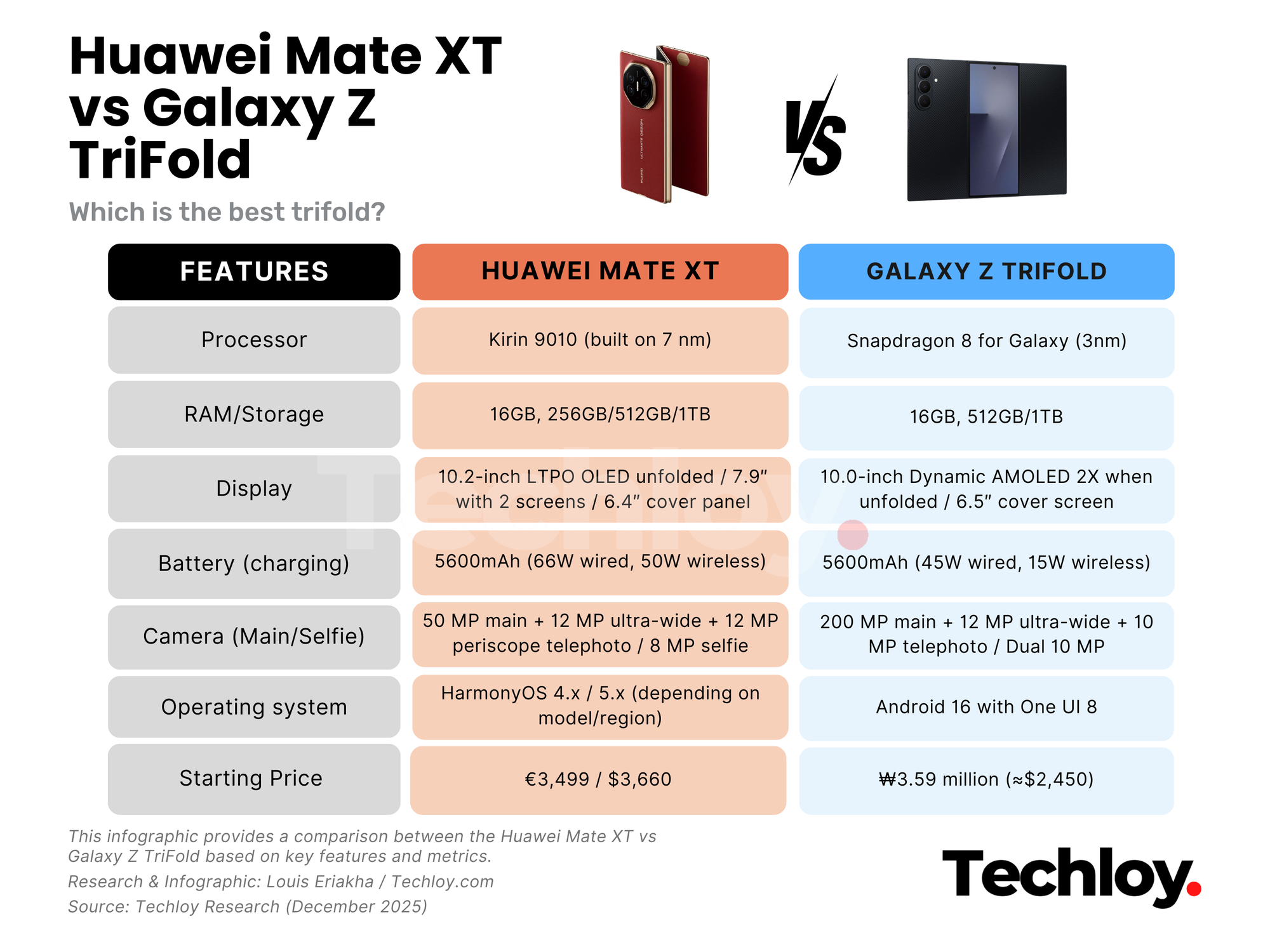

Enter the Galaxy Z TriFold, launched in late 2025. This device represents the pinnacle of foldable engineering, unfolding twice to reveal a massive 10-inch inner display while maintaining a 6.5-inch external screen. At just 4.2mm thin when open and 12.1mm folded, it’s a marvel of design. Powered by a Snapdragon processor, it boasts a 5,437mAh battery, triple-camera setup, and peak brightness of 2,600 nits on the outer screen. Priced starting at around 3,594,000 won ($2,500 USD) in South Korea, it’s positioned as a premium, limited-edition product. Yet, despite this hefty tag, Samsung isn’t profiting—far from it.

Unveiling the Galaxy Z TriFold: A Technological Marvel

🌈 Let’s break down what makes the Galaxy Z TriFold stand out. The device features a unique dual-hinge system that allows it to fold in a Z-shape, expanding from a standard smartphone form factor to a tablet-like canvas. The inner 10-inch OLED display supports a 1600-nit brightness, ideal for productivity tasks like editing documents or multitasking with multiple apps via Samsung’s One UI. The outer 6.5-inch screen ensures seamless transitions, with features like Flex Mode for hands-free video calls.

Under the hood, it’s equipped with high-end specs: up to 16GB RAM, 512GB storage, and AI-enhanced features borrowed from the Galaxy S series, such as real-time translation and photo editing. The camera array includes a 50MP main sensor, ultrawide, and telephoto lenses, delivering versatile photography. Battery life is bolstered by efficient power management, though the tri-fold design necessitates a larger, more complex battery structure.

Critics have noted drawbacks, like visible creases on the screen and vulnerability to scratches—issues highlighted in durability tests where the device bent under pressure. YouTuber JerryRigEverything famously declared it the first Samsung phone to fail his bend test outright. Despite this, early adopters praise its versatility, turning it into a portable workstation. In markets like the UAE, it’s fetching over $3,000, while gray market prices in India soar to $4,000-$5,000. Samsung has already moved 50% of its initial stock, indicating strong niche demand.

But here’s the twist: even at these prices, production costs are higher. Reports from Korean outlet The Bell reveal that Samsung is absorbing losses per unit to make the device accessible to enthusiasts. Vice President Lim Sung-taek emphasized at the launch: “This is a special edition product… we made a grand decision to reduce it and achieve this difficult price.” This strategy echoes past tech launches, like consoles sold at a loss to build ecosystems.

The Financial Reality: Breaking Down the Losses

Now, to the heart of the matter—Samsung’s reported losses on each Galaxy Z TriFold sold. According to multiple sources, the production cost surpasses the retail price, leading to a deficit per unit. In South Korea, the phone sells for about $2,500, but estimates suggest manufacturing expenses hover around $2,600-$3,000 or more, factoring in R&D, materials, and supply chain challenges.

Key culprits? The intricate dual-hinge mechanism, which requires precision engineering to ensure durability and smooth folding. Displays are another major cost driver; sourcing flexible OLED panels for a tri-fold setup is expensive, especially with global shortages. The AI boom has exacerbated this, driving up RAM and memory prices by 30-40% as manufacturers pivot to high-bandwidth modules for data centers. Samsung, as a major memory producer, feels this pinch internally.

Moreover, the limited production run amplifies costs. Unlike mass-market devices like the Galaxy S series, the TriFold is made in small batches—aiming for just 30,000 units total. This avoids economies of scale, where bulk manufacturing reduces per-unit expenses. Reports indicate only 3,000-4,000 units sold so far, with quick sell-outs in key markets like South Korea, the US, UAE, China, Singapore, and Taiwan. Samsung isn’t pushing aggressive marketing; no widespread ads or promotions, keeping it as a “proof-of-concept” to test waters.

Experts suggest this is intentional. By selling at a loss, Samsung positions itself as an innovator, willing to invest in cutting-edge tech to outpace rivals. As one analyst noted, it’s about “extracting value by proving tri-fold capability” rather than immediate profits. Historical parallels include Sony’s PlayStation launches or Amazon’s Kindle strategy—initial losses recouped through long-term ecosystem growth.

Why Take the Hit? Strategic Reasons Behind the Move

Delving deeper, Samsung’s decision to lose money on the TriFold isn’t reckless; it’s strategic. First, competition from China looms large. Huawei’s Mate XT, the world’s first commercial tri-fold, launched earlier and set benchmarks. Priced similarly high, it faces global limitations due to US sanctions barring Google services. Samsung leverages its Android ecosystem advantage, but to “beat Huawei” in innovation optics, it rushed the TriFold—accepting losses to claim market firsts.

Second, component inflation plays a role. The global chip shortage, intensified by AI demands, has spiked costs for Snapdragon processors and memory. Samsung’s reliance on Qualcomm’s Snapdragon 8 Elite sets a high baseline, compounded by its own supply chain shifts. Vice President Lim highlighted “various issues, such as the memory price,” as barriers overcome through “grand decisions.”

Third, this aligns with Samsung’s broader roadmap. The company scrapped “Edge” and “Pro” rebrandings after the S25 Edge flop, focusing on core lines. For foldables, low production (e.g., halving Z Flip7 and Z Fold7 goals to 5 million units) reflects caution amid plateauing sales. The TriFold serves as a halo product, boosting brand prestige and gathering user feedback for future iterations. As sales remain niche—expecting 30,000 total—losses are contained, unlike if it were a flagship volume seller.

Finally, it’s a bet on maturation. Foldable tech is young; costs will drop as yields improve and suppliers scale. Samsung has done this before: early Z Folds were pricey experiments, now more affordable. By absorbing hits now, Samsung paves the way for profitable tri-folds in 2027 or beyond.

Sales Performance: Niche Success Amid Challenges

Despite the losses, the Galaxy Z TriFold isn’t a flop in terms of demand. It sold out rapidly in launch markets, with 3,000-4,000 units moved initially—strong for a $2,500+ device. Projections peg total sales at 30,000, a fraction of Samsung’s 10 million annual foldable goal but intentional for a “special edition.”

This scarcity drives hype; in Dubai, it’s $3,000, and India’s gray market hits $4,000-$5,000. X (formerly Twitter) buzz shows enthusiasm, with users noting half the stock cleared quickly. However, broader foldable adoption lags: Samsung cut production forecasts, joining Chinese firms canceling models amid softening demand.

Critics on platforms like X point to durability woes—double creases and bend failures—as deterrents. Yet, influencers highlight its potential, despite scratches. Overall, it’s a win for brand image, not bottom line—yet.

Battling Giants: TriFold vs. Competitors

In the tri-fold arena, Huawei’s Mate XT is the primary rival. Both unfold to 10-inch screens, but Huawei’s is thinner (3.6mm open) and boasts a larger battery. However, Samsung’s global app ecosystem gives it an edge outside China. Pricing is comparable, but Huawei’s sanctions limit appeal.

Other players like Google (Pixel Fold) and OnePlus focus on bi-folds, leaving tri-folds niche. Samsung’s losses allow aggressive pricing to undercut perceptions of overpricing, pressuring competitors to innovate or match.

Implications for Samsung and the Foldable Future

This strategy could redefine foldables. For Samsung, short-term losses (estimated in millions, given low volume) are offset by long-term gains: data on user behavior, refined designs, and market dominance. It signals commitment to innovation amid S26 pricing uncertainties due to RAM spikes.

Industry-wide, it highlights challenges: high costs, supply issues, and consumer hesitation at premium prices. If successful, tri-folds could become mainstream, dropping to $1,500 by 2030. But risks remain—if demand fizzles, Samsung might pivot back to bi-folds.

Wrapping Up: A Foldable Future Worth the Risk?

In conclusion, Samsung’s losses on the Galaxy Z TriFold are a deliberate investment in tomorrow’s tech. 🎉 By prioritizing innovation over immediate profits, the company is betting big on foldables’ potential. As we await US launches in early 2026, this story reminds us: true breakthroughs often come at a cost. What do you think—worth the gamble? Share below! 📱